There has been no slowdown in the advancements in reach and ease of use when it comes to trading worldwide. As the no. of traders increases (not just in the US, but everywhere), demand for the right tools to help traders is at all-time highs and will only continue to increase.

Due to the proliferation of such tools and a lot of misinformation, false advertising, etc., there's a lot of confusion and decision fatigue among traders.

But are traders still making the right choice? Are there any worthy products? What's the current journaling market scenario? Where does TradesViz fit in here? What are the best tools? What are the expectations of traders and has there been any shift in what is considered important?

This is going to be an honest, unbiased insight into these questions and the general field of journaling based on our experience interacting with users and developing TradesViz since 2019.

Expectations of traders and changes

Automation

The #1 request remains the same: Automation & Ease of use. While we at TradesViz have made progress in bringing in more auto-sync brokers, it seems there is still ground left to be covered in terms of the retail trading market when considering not just the US, but popular markers across the world.

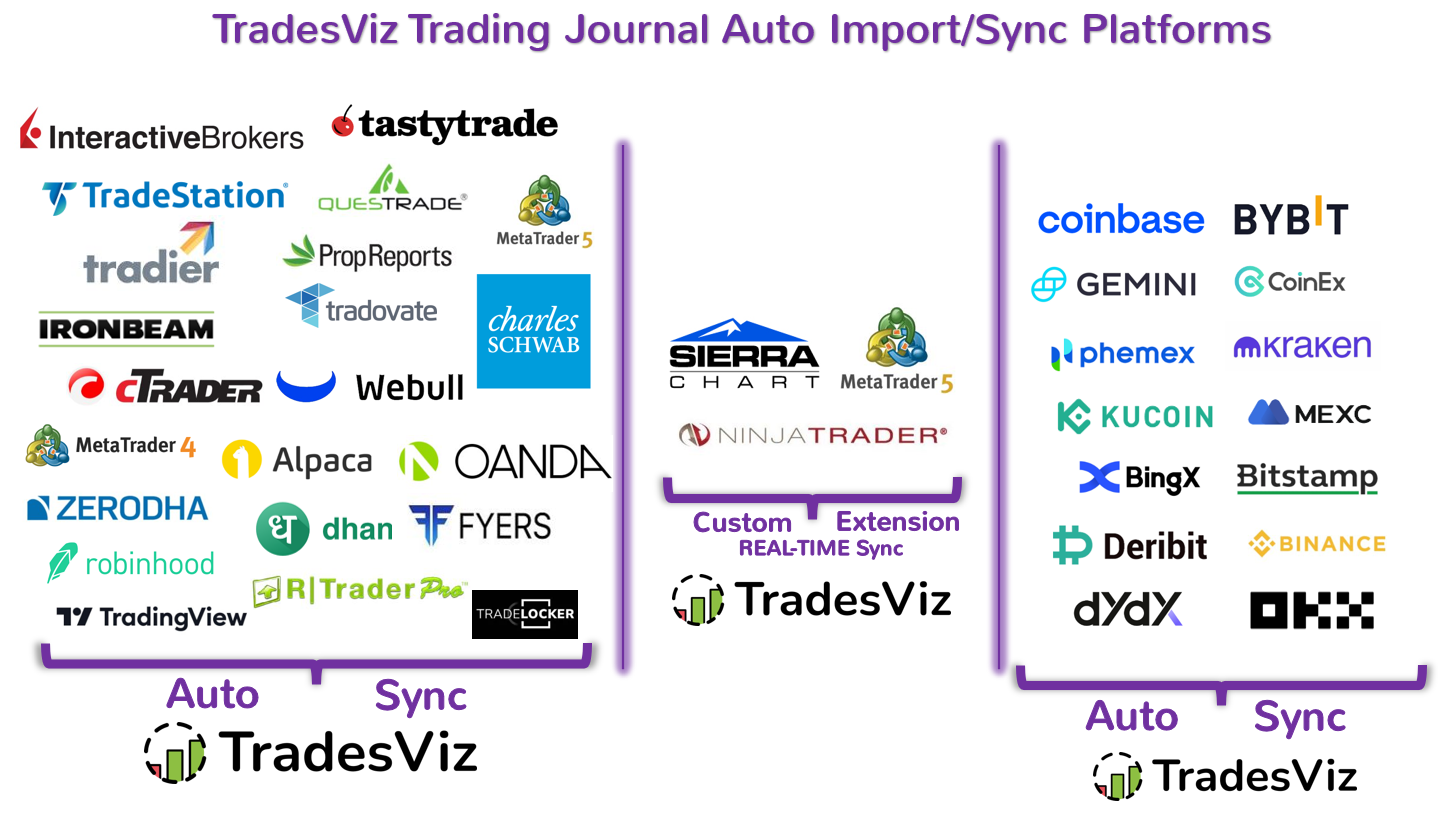

It has been 4 years since we added the first auto-sync broker to TradesViz. The count (100% auto sync, semi-auto, real-time) now stands at 40 - the highest in the world among any trading journals (No, we're not counting every platform that comes under like common API providers like MT4/MT5, Ninja, Proprepots, etc. - if that's the case, the count in TradesViz would be 1000s, but that's meaningless... isn't it?...).

The reason for this request still being at the top is simple: Traders want a simple flow of data from brokers to an external platform to cover for the lack of a better analytical tool provided on the broker's side. There's no need for a broker to focus their efforts on a journal because that effect is better spent on improving the actual trading experience. But it gets more complex now because users now have different preferences for brokers/platforms when trading different asset types. The average unique trading platform used by a TradesViz user is 3. So the problem now boils down to - how can a trader access ALL of this data reliably and seamlessly synced into a single platform.

Solution?

Our humble opinion is that if more brokers can open up their APIs or provide access to other companies with the permission of the user (like all existing brokers you see above in our list do), it would make the user's lives a LOT easier. Is this something we or any other journaling company can do without anyone's help? No.

Flexibility

This is 2024. The era of fixed dashboards with few charts and stats the developer or the company deems useful is gone. Why? due to the sheer amount of increase in asset types, and how an asset type can be traded has naturally led to the traders requiring more ways to explore their data.

Since the inception of the 100% custom dashboard in trade journaling (which we introduced in early 2022), traders have been wanting the same on every platform (which... still isn't close to being available...). However, this also creates a problem.

What problem, you ask? Having choices means you need to spend time to decide on what you need. So isn't this conflicting? In many cases - yes, it is, and while we've tried to solve this problem by offering guides, templates, and more, what deters users is that when see something being advertised as customizable, they try to learn it and in the end, it ends up being not as customizable as they want OR they don't want to spend time on customization at all.

Solution?

Users *MUST* spend time on a platform to learn how they want to customize it. There's no shortcut here. If you are a serious trader, this should not be a problem at all. Products/companies must be *CLEAR* on what is possible and what is NOT possible in the advertising or marketing material to NOT waste a user's time. The number of times we've had conversations with users coming from other platforms to TradesViz with the reason that "it was not what it says of the box" is too high and, unfortunately, increasing...

There's also a lot of work for us to do here because it's a fine line between abstracting away all the elements, dumbing down the UI while also losing utility and carefully creating a consistent design language that's easy to learn so users of all experience levels can spend minimum time of the platform to get maximum utility.

Value/Cost

Ah, the most visited page after the landing on any online product... the pricing page. So what's the best deal a user can expect? It's free/$0 right? Unfortunately, that does not really work if you wish to use a product of good quality for a reasonable amount of time. Think about it this way. To develop a reasonable product, it *at least* takes a team of 5-10 people to develop, design, debug, add features, provide support, etc., and remember that this isn't a high-margin business. Meaning, subscriptions are not in thousands of $.

Ok, look. We are not complaining here that everyone wants free stuff. But look at the *value* it provides you.

If a platform can help you track your trades (every part of it), visualize them, chart them, automatically get them from your broker, combine them with market data, show you insights, generate trade ideas every day, let you replay/simulate your trades, backtest your ideas and more (phew..), etc, etc, isn't it at least worth $20 or $30/mo?... Sure, you may not want some of these features, but the very basic features such as importing/syncing, charting, analysis, insights, and note-taking (the pillars of trade journaling) are offered for less than the price of your coffee per month, isn't that worth it?...

Solution?

Spend some time reading the pricing page of the products you wish to buy. Talk with the support to choose the right plan. Here's what we can guarantee: there isn't any journaling platform that provides as much as TradesViz for the cost you are paying.

If you are just a beginner trader with a very small amount of funds (less than $200-300) and only trade in one broker, just use an Excel sheet because ever $ matters (you probably would never find a journaling company saying this...). Once you have some more funds, get a simple monthly sub. on TradesViz and start a Pro plan.

Do you think this is just biased advertising? Read on and you'll why it's NOT.

We'll explore more about cost, value, and what's available in the market for traders as of now in the later sections which... you may find it eye-opening...

Current market scenario and overall comparison with TradesViz

Currently, there are few tools in the market that are aiming to be a trader's preferred trading journal. While there are at least 20 or 30 unique journals, we'll keep this short and just focus on the ones people seem to be talking about/using mostly.

Before getting into the details, let's look at a quick summary of current offerings in FinTech compared to features available in TradesViz

| Feature/Product | TradesViz | Other Journals 1 | Other Journals 2 | Trading Simulators | Data Visualization Tools |

| Basic trade journaling | Yes | Yes | Yes | N/A | N/A |

| Note-taking/tags | Yes | Yes | Yes | N/A | N/A |

| Auto-sync | Yes (40 brokers + Real-time sync) | Limited | Limited | N/A | N/A |

| Total charts/Stats | 600+ / Unlimited using AI | ~150 | ~50 | N/A | N/A |

| Custom dashboards | 100% custom | Very limited/ N/A | Very limited/ N/A | N/A | N/A |

| Market data integration | Options flow, relative volume, Index comparison, 5+ indicator comparison | Limited market comparison | N/A | N/A | N/A |

| Automated Insights | Stats-based summary/AI-powered summary | N/A | N/A | N/A | N/A |

| TradingView charts for plotting | Advanced settings, indicator templates, up to 5-sec charts | Very limited | Very limited | Yes | N/A |

| Trade replay | Available for all asset types | N/A | Limited | N/A | N/A |

| Trading simulation | Available for all asset types | N/A | Limited | Yes | N/A |

| Backtesting | Available for all asset types across 4 markets + global indices | N/A | N/A | N/A | N/A |

| Trading Calendar | PnL/Market events/Notes/Tags/R-value & more | Limited (only PnL) | Limited (only PnL) | N/A | N/A |

| Advanced trade tracking | Tag groups, Trade plans (checkboxes), Pivot grid | N/A | N/A | N/A | N/A |

| Daily trade planning | Day explore, watchlists, day plans, day notes | N/A | N/A | N/A | N/A |

| AI Features | AI Q&A, AI Notes, AI Summary | N/A | N/A | N/A | N/A |

| Seasonality analysis | All symbols + seasonality portfolios | N/A | N/A | N/A | Yes (some platforms) |

| Options flow data | In-depth options flow (historical) analysis + options screener | N/A | N/A | N/A | Yes (live/historical available on some platforms) - very little analysis |

| Fundamentals/SEC13F | Available for all US/IN symbols | N/A | N/A | N/A | Yes (some platforms) |

| Cost | $30/mo, $270/year | $50/mo, $600/year | $50/mo, $400/year | $35/mo, $350/year | $30-$200/mo |

All of the above are undiscounted costs as on the pricing page for compared platforms. We're certain most users can understand what platforms are being compared.

The gist is the following. Why are most of the platforms so expensive? Some of them don't even have free trials, some don't have a monthly plan. We don't want to leave traders with such a poor selection of choices. That's why we expanded from being only an online trading journal to providing all important tools to most traders.

Cost of TradeViz per year: $270

Cost of any one of the other journals + simulator + data viz. platform: $400 + $350 + ~$300 = ~$1050

Make sure to take the right decision. Now to help you do that, we'll get into the details comparing other journal's features below.

TradesViz: Officially launched in 2020 and we just celebrated our 5th anniversary. If you are already a user, you know it's the best and how much more it offers than any other competition. Our guarantees: Learn it once, Learn it well, and it will forever be useful. Constant improvements every week with the singular goal of pushing the boundaries of trade journaling and making sure EVERY trader in the world has an affordable no-compromise trading journal.

Some solutions are now undergoing redesigns and revamp which we guess is a way to compete with our v2.0 launch that completely changed how users approached flexible journaling in a modern interface with the state-of-the-art tools. However, every one of these new resign solutions seems to fall short of the user's expectations.

Other solutions are worse - they are stale. Zero improvements to interfaces, no new features, nothing to help the trader of the current generation.

One way some of these solutions "seem" "attractive" is due to the marketing hype. It's more of a way to lure users to pay, but forget about the actual user after that. On that topic, support is another big differentiating factor. From what we've heard? pretty much non-existent in most services (We have 9-5 live support M-F in TradesViz with <24-hrs TAT on all days - *for all members*).

The rest of the competition including the solutions other than TradesViz mentioned above - i.e. the overall market seems to be riding on one thing: marketing and extra offers with plenty of false promotional content (to the point where fake PnL screenshots are repeatedly shared...). You'll never find such content on TradesViz's socials. Our goal with our social reach is to teach traders about journaling and anlaysis.

TradesViz Stat of the day: Trade expectancy

— TradesViz | Trading Performance Analysis (@tradesviz) June 26, 2024

𝑓ormula: (Average winning amount x Win ratio) - (Average losing amount x Loss ratio)

Meaning: Overall, what is the amount you gain on average (gain because $ can be +/-) per trade?

Importance: Has correlations with win rate and… pic.twitter.com/re9hLrglfr

TL;DR? It's a sad state of affairs for traders to have to choose between the "shiny" products instead of researching and choosing the on that actually helps achieve their trading goals. Of course, we're not.. really.. blaming anyone here... but you know... it's always better to do some research on what's best for your future progress :)

Here's what we generally look for when *we* at TradesViz choose products for personal purposes: Cost efficiency, quality of features, improvements/fixes done, and active support. That's it. As long as there is a dedicated team of engineers behind them who know what they are doing and are focused on providing value, that product - even if not popular, will remain the preferred choice among users who take their craft seriously.

What we've discussed about so far is just the overview. Now we'll get to the actual features comparison which frankly doesn't look good for the competition...

1. Custom dashboards: If rearranging a list of 10 boxes of fixed stat/chart passes for a "custom" dashboard these days, then we're not really sure what to call what we have on TradesViz where you have up to 50 unique widgets chosen from among 600+ list of stats/charts and top of that, have your widget created using AI...

Rants aside, competition is severely lacking in this despite heavy marketing about it.

2. Stats/Metrics: Have we still not evolved from the bar charts of the 90s? Actually, it's a bit worse now with journaling making up their own stats with the product name in the stat... The stats we use for anlaysis and journaling are 1) either heavily used in literature or 2) if relatively lesser known or are derived statistics, will have very detailed blog posts on TradesViz on how they are derived, how they can be used, the caveats/gotchas of using it. NONE of this exists on ANY competitor. Imagine a new trader looking at a makeup statistic and using it to make trading decisions.

Ok, all that aside. What are other journals really offering users in terms of advanced metrics? There is only one solution that even remotely compares to TradesViz. While it is one of the earliest online trading journal, it has not improved much in over a decade. The stats we currently offer are not something we "invented", rather, it's all based on discussions from users on what metrics can be combined and visualized in unique ways to make traders understand their trading behavior better - after all, isn't that the whole point of having a trading journal?...

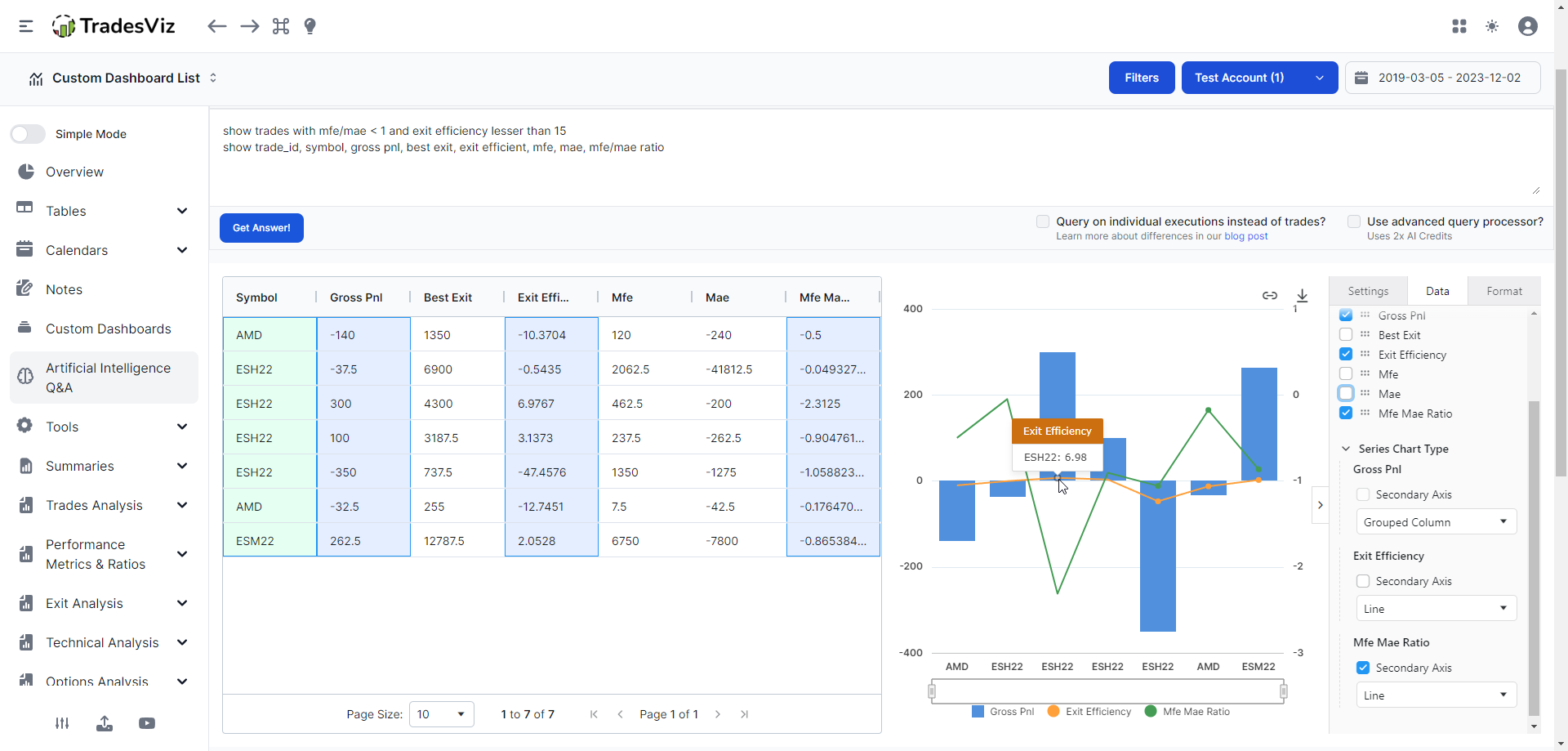

Here's a real example of comparing the MFE/MAE ratio and exit anlaysis in a single chart. What journal can do this? None except TradesViz. This is a good example of how *useful* AI features can completely change your perspective on trading anlaysis. This brings up to the next topic...

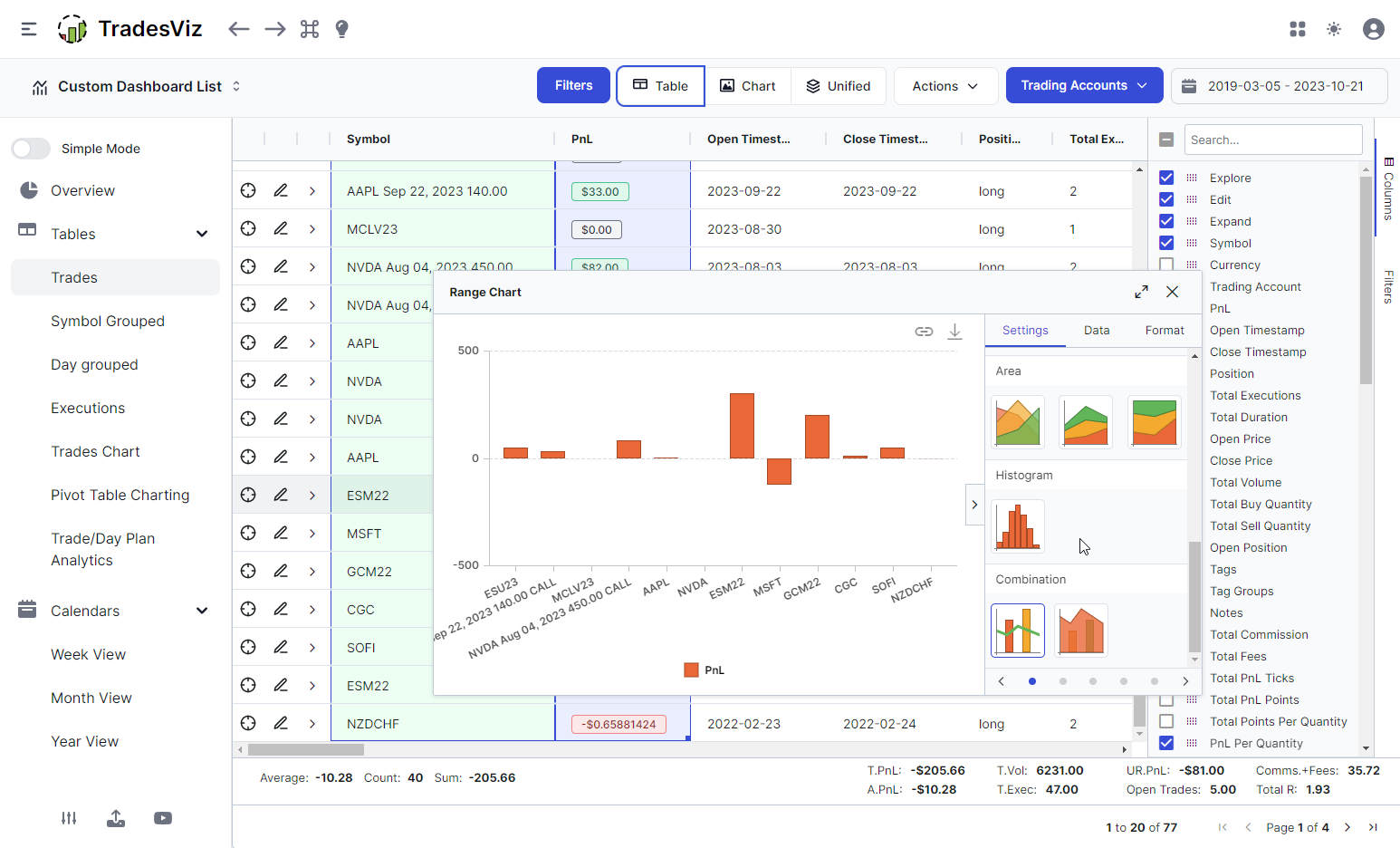

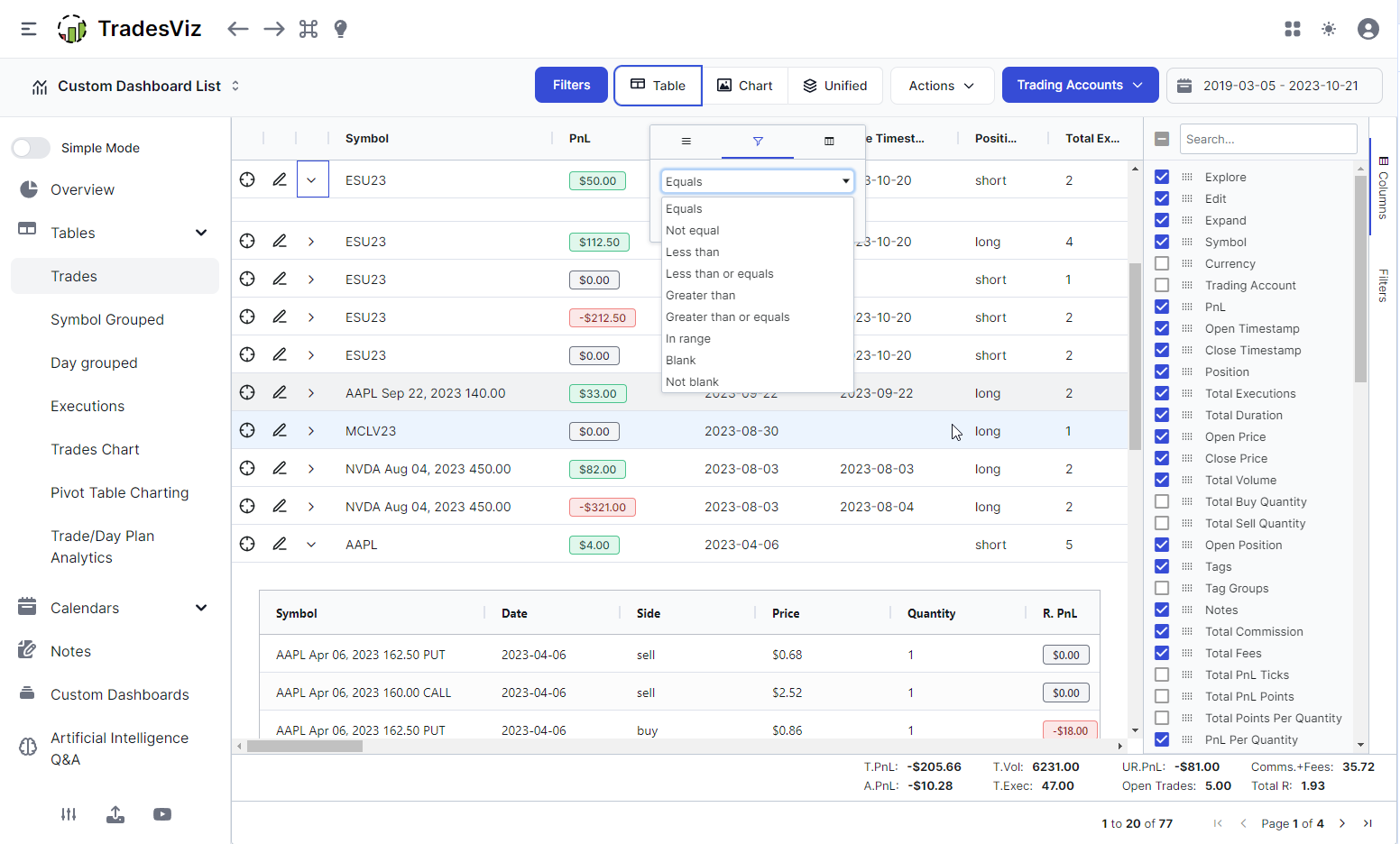

3. Advancements: Charts, tables, calendars, stats - the building blocks of any trading journal have largely remained unchanged in overall looks. However, UTILITY has increased multiple-fold with newer charting and tabular technologies. TradesViz currently has the most advanced tabular grid you can find online. Sorting, charting, filtering, custom columns, and more. You are limited to sorting and filtering (if you are lucky) in other solutions - it stops there.

|

|

We've barely scratched the surface here. If you want to know why, we'll just leave the link to our most powerful single-tab feature (pivot grid) here: https://www.tradesviz.com/blog/pivot-grid-charting/. We're sharing this so that you can understand how far ahead TradesViz users are in terms of understanding their trades and just to show what we have on TradesViz. The point is that this *improves* the trader's exposure to trading analysis - it adds value and broadens their knowledge of how they can find their trading edge by leveraging technology.

Up next is AI. Even before TradesViz started or probably at its inception, there were advertisements about AI "agents" in journaling that provided insights. It was BS at first sight. They seem to have toned it down with the false marketing, but it still exists as a "feature"...

So far, the only journal with real AI features is TradesViz.

- AI Q&A: Ask your trading journal questions about trading data (objective, not subjective ones)

- AI Notes: Create a summary of your trade using trade + market data

- AI Daily Insights: Create a summary of your recent trading data every day

AI Q&A has been the most revolutionary feature in the field of trade journaling and we've seen so much potential in it. Since the launch, users of TradesViz have logged over 15,000 unique AI queries. That's 15,000 unique questions asked about their trading accounts - all private, no sharing, zero data goes out of TradesViz. For every feature, we provide *a very* detailed explanation of how it works, how it can be used, and how the data is used.

Is at least 5% of any of the above present in any competitors? No.

Now your question, naturally, is why isn't everyone choosing the obvious answer here? The sad answer is a lot of the users are either stuck (cannot export/get years of data out of the platform) or they simply don't want to expand their horizons or try new technologies. We understand the latter - they will eventually have to move on, but the former is simply gatekeeping which we never condone. You can always export ALL your execution data at any time from TradesViz - either by asking us or by using the export functionality on the import/export page. It's a generic easy to understand format that anyone can use to re-construct trades without ANY loss of information.

This is a problem because - think about this: A user tries out a competitor with high hopes only to be disappointed with misleading advertising and half-baked features and they get zero benefits out of trying to journal their trades. That's going to leave a bad taste about journaling and journaling tools. It's going to prevent that user from even trying similar products in the future - this is completely not the user's fault. Most FinTech tools in the current generation have become a way to quickly get popular with gimmicky features and enormous marketing spend to initially lure in the customer and then destroy the trust and the reputation that the field has. There is too much effort into reinventing the wheel rather than combining/joining hands to balance our strengths and weaknesses and provide far better, more complete, more comprehensive bundles/solutions to the end user.

A solution to all of this?

- Hopefully, larger companies/brokers pick the truly valuable products and suggest them to the users. Smaller companies like ours have to be careful about where the profits are spent. We dedicate 100% of our resources/budget to engineering, support, and research in trade journaling. 0% is spent on ads. This is a win-win-win situation for everyone, the introducing platform, the smaller better-than-the-rest company focused on providing value, AND for the customer who gets to realize that there is a far better option available.

- Hopefully, traders take a chance on something new (all new users on TradesViz and start a FREE 7-day full access trial).

- Hopefully, traders don't fall to false marketing and hype easily.

- Hopefully, traders learn the real value of a subscription/cost they are paying for and realize not all subscriptions/products are created equally... expensive =/= good - FALSE. cheap =/= low quality - FALSE.

A product CAN be high quality AND cheap.

Finally, hopefully, traders spend more time researching and studying a platform on how well it can help them - not just now, but in the future also.

A summary of TradesViz's progress

Our progress in the last 2 years is summarized below.

|

|

Look at the competitors or if you are using a solution other than TradesViz, look at your dashboard. Do you see any improvements over the last year? No? It's time to move on. TradesViz v2.0 was a major milestone for us because this greatly improved *every single* feature in TradesViz.

We really mean it when we say every single feature was improved.

|

|

On top of just journaling, we also provide:

- The world's only universal trading simulator (35,000+ tickers)

- Second-by-second simulation of ALL US stocks, futures, forex, and options (options chain simulation)

- Technical analysis Backtesting

- Seasonality/Options flow analysis

.. and more!

What is next? How can we improve?

Are we at the saturation point of journaling features? No. But is that going to stop companies from trying to reinvent the wheel and try to sell/provide a poorly implemented/half-baked product? Also, (unfortunately) No.

So, let's just focus on the first question: How can WE improve?

We have spent some time thinking about AI-based features and how to make anlaysis itself more useful. This is *definitely* the next frontier in trading analysis. Anyone NOT leveraging this WILL be left in the dust. Look around you - who **isn't* using an AI-based product? who isn't using ChatGPT or similar tools to increase productivity? Similarly, who is the only journal looking into this field? So far? Just us. But there's a huge caveat here: we cannot provide hallucinated answers or results to traders. That's why we do extensive testing on all our AI features. But even that is not bulletproof. So we are trying to come up with ways to do 100% accurate AI "assisted" approaches to advanced journaling analysis.

We also wish to provide the next level of data access to traders. What do mean by this? We're the only platform in the world to provide users with access to high-quality, second-level data for US stocks and options, OHLC data for US/IN options, and options flow data. While all of this can be used to do plenty of research, and analysis and primarily for idea generation, we also want to provide users with real-time data for real-time journaling, screening, and more. We've created so many useful features/tools using just historical data so we're very excited to think about all the NEW generation of tools and features we can offer once we get real-time/live data. That will be one of our next goals.

Finally, we are always looking for opportunities to solve the #1 most requested feature from most traders from all over the world "Do you have auto-sync for <insert their broker here>?" We want to be able to say YES to ALL such questions. But saddens us that we've barely made any progress in this. We really wish brokers take our and their clients' requests about API-based data access seriously or at least include it in their short-term roadmap (heck, at this point, we'd be happy at an announcement that they are thinking about it...)

If you read all the way to the bottom, thank you for expressing so much interest in the field of trade journaling. If you are an existing user of TradesViz, Thank you very much for your support - you matter, and the help and feedback you provide matter to us. None of what we wrote would be possible without listening to user's feedback day in and day out here at TradesViz and we love interacting with our users!

If you are not yet a user, we hope we have provided a fair comparison of features among similar solutions and what might interest you in TradesViz. We're not sure if there are any similar posts out there comparing not just features in a tabular format, but actually discussing the past, present, and future of this field and its competitors. We hope this gave you a good idea of what is currently present in the industry and what you should be looking for. As always, we are very open to feedback which you can email to us at [email protected].